What I need from a buyer in order to show my Arizona Real Estate Listing

I got an email inquiry today from someone that wanted to view a listing I have in North Mesa. There was no name or phone number on the email only a return email address. The email said, “I would like to view your listing as soon as possible.” I have to admit, I am immediately skeptical when someone prefers to stay anonymous behind an email address and fails to give their name or phone number so that we can dialogue on the phone. However, I also realize that some folks are just wired with that, “less is more” mentality and this could still be a potential lead to getting my clients home sold.

While I need to get the home sold, I also have a fiduciary responsibility to protect my clients best interest. Qualifying buyers ahead of time is just one way in which I do this. I take it very seriously and really don’t want anyone in my client’s home that is not prepared or qualified to purchase the home. If you are working with a REALTOR, then I trust that the other REALTOR has taken the time to qualify you before they spend their time driving you around. If you are not working with another REALTOR, there are a few things I will need to discuss with you and verify before I meet you out at my sellers home.

Below is the email I sent to this inquiry this morning:

I am following up on an inquiry on my listing at 3321 N. Hawes in Mesa AZ. Thanks for you email and interest in the property – its really a special home!

To protect my clients that have entrusted me with marketing and selling their homes, I do need to verify a few things with you before I can show you the home on Hawes:

![]() That you are an able buyer. I need either a pre-qualification letter from a lender or a statement of funds from your financial institution (if you are planning on purchasing with cash.) If you need a lender, I am attaching a list of lenders for your consideration.

That you are an able buyer. I need either a pre-qualification letter from a lender or a statement of funds from your financial institution (if you are planning on purchasing with cash.) If you need a lender, I am attaching a list of lenders for your consideration.

![]() That you understand that I am representing the seller. I have attached an Agency Disclosure Statement for you to review. It is important that you understand who I am representing and the duties owed to the different parties involved. I will ask that you review it and sign that you received it before I meet you at the property.

That you understand that I am representing the seller. I have attached an Agency Disclosure Statement for you to review. It is important that you understand who I am representing and the duties owed to the different parties involved. I will ask that you review it and sign that you received it before I meet you at the property.

![]() I need to verify that you have have not signed an employment agreement or buyer broker agreement with another REALTOR. If you are working with another agent and/or have signed an employment agreement with another REALTOR I need to know. Please discuss this with me prior to any meeting we might have.

I need to verify that you have have not signed an employment agreement or buyer broker agreement with another REALTOR. If you are working with another agent and/or have signed an employment agreement with another REALTOR I need to know. Please discuss this with me prior to any meeting we might have.

I am including 4 documents for your information/education.

- The Agency Disclosure I mentioned above that states you understand as a buyer that I am representing the seller only.

- A Pre-Qualification Form That your lender can fill out.

- Arizona Buyer Advisory – this just has a lot of really good information and buyer resources for you as a buyer. Utilize this document with any residential Arizona property purchase you might be considering.

- A List of Lenders– for your consideration.

If you have any questions please don’t hesitate to call or email me. My toll free number as well as other contact numbers are below.

The home on Hawes is truly a beautiful one-of-a-kind home. I look forward to hearing from you soon to set up an appointment for my business partner and I to meet you at the home at your earliest convenience!

Best Regards,

Tiffany

Tiffany Cloud, Realtor® ABR, BSW, CDPE, CSSN, CRS, GRI, e-PRO

HomeSmart

480.784.7600 | Direct

480.247.4933 | e-Fax

888.668.4629 | Toll-Free

Tiffany@CloudHomes.com – email

CloudHomes.com – main website

A Random Act of being Neighborly – Taking the Lead in Protecting Your Neighborhood’s Value

I read an article today that I found fascinating. It was just a little snippet of an article, only 4 short paragraphs. It was entitled, “Survey: Well-Kept Yards Most Important Factor in Determining Neighborhood Safety.” The survey conducted by relocation.com , reported by RIS Media and sponsored by Lowes, found that, “75% of Americans believe the most important factor in determining a neighborhood’s safety is the up-keep of surrounding homes, especially the front lawns.” The Chairman and Founder of Relocation.com was quoted as saying, “It’s interesting to see how home buyers determine neighborhood safety based on the neighborhood’s appearance and not as much based on police statistics or crime reports.” As a Realtor® who happens to have a foreclosure or two in my own neighborhood, I couldn’t help but think how the increase in distressed homes in our neighborhoods is a variable that we can’t control. What used to be an anomaly, has become the norm.

For a couple of years the government has been trying to stop the downward spiral that is our housing market. The government has infused billions of dollars into housing programs, kept interest rates low, shored up the banks making real estate loans and offered cash incentives for home buyers. Yet, we still find that foreclosures top the news on a daily basis and that more and more people are either being forced out of their homes or are voluntarily walking away from homes. The phenomenon is no longer something we hear about on the news, but one we drive through everyday on our way to work as we exit our neighborhoods…. our very own neighborhoods.

So what about our neighborhoods? What about the value of our homes? What about those homes that sit with the lawns overgrown, leaflets stacking up at the front door, empty driveways and that eerie sense of abandonment we drive past everyday? My Grandmother used to say that asking the right questions was often the beginning of the finding the right answer. If my Grandmother was right ,and she almost always was; the internal questions we ask ourselves as we drive past these abandons homes could be the key to the solution.

When is the government going to fix this housing crisis so my housing value stops free-falling?

… or …

Is there anything I can do to stop the value of my homes decline?

When is someone going to start taking care of that home?

… or …

Is there anything I can do to take care of that home?

Could the answer be as simple as a random act of being neighborly? What if you cleaned up that yard? Maybe a neighbor seeing you work on the yard would offer to help, or maybe they might do it in a week or two? What if neighbors took turns occasionally parking their cars on the street out in front of the home lending a ‘presence’ to the home? What if several neighbors got together and made a rotating schedule of when they would do some front yard maintenance? [Although it irritates me to no end to have to make this side note, I must. I am not a lawyer and I can’t give legal advise – but you do need to have a property owner’s permission before trespassing or working on another’s property and you do need to be aware of the fact that there might not be any kind of homeowner’s insurance policy on that home. Don’t give up easily though, contact some local authorities to see if there is a way you can work around such a dilemma. Is there a neighborhood task force that the City helps underwrite and insure to clean up these properties? If not should there be one…hint, hint, hint? Contact the bank that own the property, contact the local health department if there is garbage left, see if a local boy scout troop could do a clean-up….Let’s think outside of the box folks, this is important. There, done – now back to the benevolent spirit of this post]

Starting with abandoned homes is a great first step, but let’s take it a step further, a BIG step further. What about those homes in your neighborhood where there are still people living in them and you see them start to deteriorate? Oouch, that is a lot harder.

We had a home in our neighborhood that has always been maintained start to go into dis-repair. I knew something must be going on because for 6 years the home had always been maintained. My gut reaction was that I needed to check in with these neighbors and see if everything was OK; but then I immediately started talking myself out of it. They might think I am being nosy, what if they think I just want to gossip to the other neighbors? What about their privacy? What business is it of mine? We had only ever chatted about our kids and the weather….I took a risk and called them up and as non-threatening as I could be, asked them if there was anything I could do to help. I let them know that my attention was not to intrude, but that if they had some kind of need that I might be able to help with, I would sure like to know about it so I could help. They were so relieved that I had asked. I was a little shocked at how relieved they were. What followed was an hour-long conversation and several follow-up conversations after that. It turned out that in fact there was something I could do to help, and 4 months later that yard looks better than it has in years. Their mailbox has been replaced, the yard looks fantastic and those neighbors of mine have some hope again and they are taking pride in their home as they once had. It made me feel really good. The government couldn’t help my neighbors out, but I could and in doing so, I helped my whole neighborhood out.

I thought that worked out pretty good, so when the opportunity arose again a month later I again forced myself to take the initiative. In another home just outside of my neighborhood I had seen an elderly gentleman struggle in and out of his car. His whole property was in disrepair and had been for quite some time. While I had often muttered to myself as I drove by that I wished he would clean it up, I had never stopped to ask myself, “Can he clean it up and might he need some help?” So, I forced myself to stop one day when I saw him outside and chatted with him for a while. I had never met or spoken with this man before. We had a lovely conversation and I was able to at one point say to him, “You know I have been driving past here almost everyday and have always meant to stop. You have a really large yard and I hope you don’t mind me asking if you need help with the yard or anything else?” He very kindly told me he was,”good” and didn’t need any help. I left feeling glad to have made the connection with him and to let him know that a neighbor cared about him. Do you know that he was out there working on his yard not two days later with a big smile on his face? Possibly he just needed to know that the neighbors cared and in turn that caused him to want to care about us back by cleaning up his yard a bit. I actually have had several really good interactions with him since then and he has spotted me at the store since then and come over to say Hi and chat. Not only did I make a new friend, but I also think that in the future if he ever does feel he needs some help, he might just be a little more willing to accept it from me or maybe feel comfortable enough to ask.

I want to be a good neighbor, I love my neighborhood. I want my kids and my family and my neighbors to take pride in our lovely neighborhood. What starts out as a random act of being neighborly can morph into so much more. Let’s take pride in our neighborhoods. The responsibility for our neighborhoods start with us not the government or the banks. Let’s start locally by loving on our neighborhoods again …. I dare you….

Tell me after reading this post… are the hands in this picture waiting for something to be given to them or are they outstretched to lend a hand to a neighborhood or neighbor in need? You decide.

What other ways can you think of to impact your neighborhood for the good in this depressed housing market. Please do share.

After You Close Your Arizona Home – Updating Your Information with the DMV

According to Arizona Revised Statute 28-448 a person is required to notify the Arizona Department of Motor Vehicle (DMV) within 10 days (calendar days, not business days) of an address or name change. A violation of this is considered a civil traffic violation. At the very least a civil traffic violation could be a hassle to get removed or could cost you a lovely Saturday in traffic school or up to a $250 fine.

There are several acceptable ways to notify the DMV of your address change. You can do it the traditional ways by driving down to your closest DMV office, calling or mailing in your current information. The easiest way to update your current address with the Arizona DMV is to go to their website ServiceArizona.com

In addition to keeping your Driver’s Licence up to date, you can change your voter registration, renew your vehicle tags, obtain a duplicate Drivers License to be mailed to you, select and order personalized or speciality license plates, check on a license plate credit, obtain a ‘sold notice’ for a recently sold vechile, obtain a vehicle tab replacement and more.

I know there is a lot to think of when your are in the process of moving that is why I send all my clients an email with this link and many other useful information to make getting their new home established as easy as possible.

Reasons a Bank Might Agree to a Short Sale

In the last 3 years I have been confronted or involved with short sales for a variety of reasons. While most people understand The definition of a short sale. [A short sale is making an arrangement with the lending institution(s) that has loaned you money on your property to accept a payoff for the property that is less than what is owed on that property.] There is still a lot of mystery surrounding the reasons a bank might allow a homeowner to do such a thing. What reasons make a short sale a viable option to the bank? Can anyone do a short sale? Why do banks allow some people to sell a home for less than what is owed and not others?

Below are some reasons a bank might allow a homeowner to complete a short sale:

1. Increase in Mortgage Payment

- Interest Rate Adjustment – is the most common reason for a mortgage payment increase.

- Increase in taxes

- Increase in Insurance

2. Relocation

- Military Service – See the Servicepersons Civil Relief Act (SCRA) for help in some cases, but for others an unexpected mandatory extension of active duty, change in assignment, etc can cause hardship.

- Job Relocation – If you have negative equity in your home and are forced to relocate for a job.

- Incarceration – It happens.

3. Severe Illness or Death

- Death of a Family Member or Spouse – Wage earner or not this can cause duress and turmoil in a family.

- Severe Illness of a family member – Medical bills and time taken away from earning wages.

4. Family Status Change

- Divorce – Often involves a separation of assets and income.

- Separation – Can involve dividing income and taking on a new household

- New Family Member– This might be a newborn, an adult child forced to move back home and that you must support financially, adult/senior parents that need financial aid or support.

5. Loss of Employment, Earnings or Benefits

- Termination of Employment

- Loss of benefits – Social Security, unemployment, child support, insurance payments, insurance coverage, etc…

- Business Failure

- Reduction of Income – Some employers are forcing employees to take a mandatory cut in wages or are not giving bonuses that were regular/customary. A commission based employee or an independent contractor can also see a reduction in income.

6. Excessive Debt

- Credit Cards

- Judgments

- Tax Liens

- Medical Bills

Now most banks are going to want to see if you qualify for a loan modification before they allow you to pursue a short sale. Realize also that you will have to prove or DOCUMENT, with a paper trail, that you have one or more of the hardships mentioned above. Short Sales can have legal and tax consequences that can vary from state to state so it’s always a good idea to consult an attorney and tax professional when deciding if a short sale is right for you.

Thanks for reading.

First-Time Home Buyer Tax Credit – Then & Now in the Greater Phoenix Metropolitan Area. Part 1 of 3, The Void

Excluding certain military personnel, the First Time Home Buyer’s Tax Credit has expired. For all practical purposes we have been left with what amounts to a void in the Phoenix Area Housing Market. I will need to cover this in three parts:

1. A look at the immediate statistical summary and define our current ‘Void’.

2. Project out and take a stab at the future and possible time tables for improvements and the factors that might and will play a role.

3. Take a broader picture of the Housing Recovery in the Greater Phoenix Metropolitan area (this is the good news, so don’t miss this one!).

The Void … The Why

Our Highest Recorded Pending Listings in this century occurred in the week ending April 28, 2010, approximately 1 month prior to the closing deadline for the first-time home buyer tax credit. At the end of April we had 15,149 homes listed as pending or under contract in our Multiple Listing Service (Just for comparison purposes, as of September 13th, 2010 we had 10,009 pending listings). With only 30 days left to get a deal closed, those that were looking to qualify for the tax credit had already made their decisions and had something under contract. In addition, something else occurred that was counter productive to helping our housing market regarding the reporting of these pending listings. Quite a large percentage of buyers had put multiple offers out on properties with the intention of only purchasing one or at least less than what they had made offers on. In their effort to try to ensure they got ‘something’, they opted for the ‘insurance’ of having more than one choice available to them when the time came to choose. When we got down to the wire of having enough time to get a deal closed (typically about 30 days) and they had to choose, many of these duplicate contracts were cancelled. Since April we have obviously seen a dramatic decrease in pending listings. We essentially had a FALSE demand that was created by these multiple contracts. When you have a greater demand, the supply goes down and of course the price goes up, or in this case, more precisely is artificially inflated by a false demand. I can tell you first hand, that buyers were panicked, and here in Arizona we had bidding wars, escalation clauses and in some areas, inventory was down to less than a four month supply which is generally considered a Seller’s market. We essentially had a mini-bubble for a few months. Well, we have learned that bubbles eventually pop, and now that the tax credit is over, our market must now correct…. AGAIN.

The Void … The Data

- According the The Cromford Report, the end of August had our current price per square foot for the Greater Phoenix area at $84.44/sqft, down from $91.12/sqft at the end of June. That is a decrease of 7.9% since the tax credit has expired only 2 months prior.

- Housing Data for Maricopa county has the current Median Sales price at $123,900 ($132,900 in June of 2010). Prior to last year, which has so far been the bottom of our market for median sales price, the last time our median sales price was at $123,900 or below was in December of 2000.

- Inventory is increasing weekly. In the last 3 months, we have added over 3,000 listings to our inventory which now sits at 44,531 up from 41,483. Inventory is up 9% in the last three months.

- Three months ago closed sales per month were at 9,312/month. Today closed sales are at 6,911/month. Closed Sales have decreased 25.7% in the last 3 months.

The Void … The Reality

As I speak to my fellow Realtors in the Metro Phoenix area, most listing agents are reporting a huge reduction in their showing activity and price reductions are on the rise for their listings. Buyer agents are consequently reporting buyers that expect ‘everything’. I got the following from an agent with buyers that were seriously considering a listing I have in Power Ranch:

“I was really surprised but I think they [buyers] are just all over the place. I will let you know what the outcome is but you should not have a hard time trying to sell that house. There is just a lot available out there for sale and not a lot of buyers who are serious about buying. I have never seen interest rates as low as they currently are and buyers just seem to want everything and if they can’t have it their way they don’t want it. Pretty fussy buyers with interest rates at their all time low!”

In April of 2009 we reached our lowest median price this decade of $119,000. Since then the market has been trending up for the most part. We had gone from a low of $119,000 in April of 09’ to $134,900 just 12 months later in April of 10’. The press had started to report things were looking up, and we started to hear some positive things happening in the housing market. In just two months since the First Time Home Buyer’s Tax Credit has expired, we have almost voided out the last year gains. I suspect we will likely reach that low of $119,000 in Sept. or Oct. of 2010, and unfortunately there is a real possibility that we will trend lower for a new all time low as inventory continues to increase.

in the next part of this series we will take a look at some of the factors that could influence the next 6 – 12 months in the Phoenix market. Of course there will be speculation and I will be relying heavily on some folks that are quite a lot smarter than I. In the third part of this series I will take a broader look at the housing recovery. There is actually quite a lot of good news to report when looking at the broader picture.

Thanks for reading.

Information gathered from The Cromford Report, Arizona Regional Multiple Listing Service, edpco.com and Arizona State University Realty Studies.

ValleyWideShortSales.com

FOR IMMEDIATE RELEASE

Local Agent Provides Free Information Resource to Phoenix Area Homeowners Facing Financial Hardships

New Web site presents options for homeowners confronted with the possibility of foreclosure.

Gilbert, AZ – September 10, 2010 – Local real estate agent and community advocate, Tiffany Cloud of HomeSmart, today announced the creation of a new information Web site for Phoenix area homeowners in distress. ValleyWideShortSales.com contains vital facts about the options available to these homeowners, to help them make the educated decisions about their future.

“I developed this site with my community in mind,” Cloud said. “When faced with the possibility of foreclosure, I’ve seen too many homeowners make poor choices, even walking away from their homes without calling their lender or a Realtor. These people didn’t know the options available, or even how to find any information on their situation.”

“I want more for Valley neighborhoods, and more comes with making informed decisions.” In addition to being a full-time Realtor for 9 years, Tiffany graduated from Arizona State University with a degree in Social Work. She practiced as a case worker for the City of Phoenix before getting her real estate license in 2002. “Educating my clients and the public has always been a core value. I can’t do business any other way,” Cloud admitted.

ValleyWideShortSales.com acts as a hub for information on the facts and issues for struggling homeowners, putting all the necessary information in one, easy-to-use location. The information and materials located on the site are regularly updated to reflect market changes, trends, new lender requirements, and industry updates.

Alex Charfen, co-founder and CEO of the Distressed Property Institute in Austin, Texas, said that more than seven out of 10 homeowners in foreclosure proceed without any visible assistance. Cloud hopes this new website will be a free resource to those with questions and help them make educated decisions.

“Agents with the Certified Distressed Property Expert® designation are helping distressed homeowners understand that there may be options available to them,” Charfen said.” Tiffany Cloud has been trained to help homeowners avoid foreclosure, and this Web site resource to educate the community is a commendable public service.

###########################################################

Negotiating: It’s more than just price

Maybe I am just getting old, but it seems that the older <wiser hopefully> I get, the more I realize that some things in life that I thought were black and white, or simplistic are actually multi-faceted, complex organisms. That is they change, evolve, they rarely lend themselves to the same criteria or result repeatedly. Kind of a heavy way to start out a blog post, but it seems the perfect backdrop to a discussion on negotiating.

I recently had a listing that was new to the market and a real ‘gem’ of a property. Pristine condition, superb neighborhood and the seller had equity! We got two significant offers on this home for consideration.

Offer 1: Emailed over with no discussion before-hand. Final net offer (after counters) was $2,500 below asking price (about 1%). 4 week close with a 3 week inspection period. Seller to pay for buyer’s VA appraisal up front, HOA disclosure fees up front. Repairs to be completed 3 days prior to close of escrow. The buyer was putting down less than .5% of the purchase price for their earnest deposit.

Offer 2: Emailed over with 3 discussions prior to writing offer. Final net offer (after counters) was $7,500 below asking price (about 3%). 5 week close with a 10 day inspection period. Earnest money of 1% of purchase price to go hard (be non-refundable) and be released to the seller 1 week prior to close of escrow.

At quick glance the first offer would seem better to most. After all, the seller would net $5,000 more right? Now let me tell you about my seller…

My seller is relocating to a retirement community. She is single now for the first-time in 30 years. She has never sold a home by herself, she has never moved a home by herself. She is overwhelmed by the thought of an inspector coming in and finding things wrong with the home that she won’t be able to take care of. She wonders if she will be able to get everything done in time by herself while working full-time.

We went with the second offer and here is why: The second offer gave my seller the two things she needed,

- A Fair Price for her home and

- The highest amount of security.

Offer 1 had my seller taking all the risk hoping the seller would still want the home in 3 weeks when their inspection period was over. My seller was scared of starting to pack up her household and make plans to secure another place to live (deposits, moving vans, etc – more money risked up front) while the buyer could back out. Remember my seller works full-time, so packing up her home is a HUGE undertaking for her. A three week inspection period with a 4 week close left her one week to pack, move, and 4 days to make repair. Not a very nice thing to do to a sweet little old lady.

The buyer’s agent on offer 2 did an excellent job of asking questions and finding out what was important to my seller. She asked a lot of questions. Let me repeat that, she asked a lot of questions. Then she …… listened when I answered her. Now my seller not only has the inspection periods over in a reasonable amount of time, but she had a couple thousand dollars sitting in her bank account before she put money down on moving vans, etc… She had some S.E.C.U.R.I.T.Y and a considerate buyer that was serious about making the transaction work.

Two Breaches don’t make a Right…

We do a lot of transactions that involve buying or selling properties that are ‘distressed’ properties. The dictionary defines distress as: a state of extreme necessity or misfortune. A distressed property might be anything from a vacant, bank-owned home, a pre-foreclosure that involves tenants being forced to move, or a traditional sale where the sellers are forced to sell and must walk away from a large down payment that has been lost to them in a declining market. Currently, 60%-70% of all homes closing in the Phoenix Metropolitan area would fit into this category.

Distressed sales are never ideal for the sellers or residing tenants and can introduce a myriad of possible problems at close of escrow for a potential buyer. What happens if the property is damaged or ‘trashed’ before Close Of Escrow (COE)? What if the occupants leaving take appliances, fans, or fixtures that are supposed to convey or stay with the property? What if a vacant property has had vandalism that has altered the condition of the home?

Distressed sales are never ideal for the sellers or residing tenants and can introduce a myriad of possible problems at close of escrow for a potential buyer. What happens if the property is damaged or ‘trashed’ before Close Of Escrow (COE)? What if the occupants leaving take appliances, fans, or fixtures that are supposed to convey or stay with the property? What if a vacant property has had vandalism that has altered the condition of the home?

What remedies do you have as a buyer of a home if one of the above problems arises shortly before close of escrow (COE) or recordation?

There is a short answer to this question and a long answer. Most people want to know if they can refuse to close until the property is ‘whole again’ or demand some kind of compensation for the damage before close of  escrow. So here is the short answer: Just because the other party has breached the contract, doesn’t give you a legal right to breach it as well. How can you be breaching the contract by refusing to close escrow? You agreed in the contract to close on a specific date. Remember your mother telling you two wrongs don’t make a right? – Yep, it’s still true.

escrow. So here is the short answer: Just because the other party has breached the contract, doesn’t give you a legal right to breach it as well. How can you be breaching the contract by refusing to close escrow? You agreed in the contract to close on a specific date. Remember your mother telling you two wrongs don’t make a right? – Yep, it’s still true.

This post was originally 5x the current length it is now, because I started with the long answer. The long answer involves taking a detailed look at the purchase contract we use in Arizona to define what the parties have agreed to in terms of:

- the condition of the property

- the inspection periods

- the seller warranties

- the seller’s obligation to inform the buyer of changes in the property

- remedies the non-breaching party has against the breaching party

Suffice it to say that there is much that can be discussed and a great deal of detail along with different ways to circumvent through the above mentioned items. It is imperative that your agent has extensive and skilled knowledge at trying to pro-actively address and protect you as much as possible. For instance, Julie and I feel it prudent to conduct 2 walk-thrus of the property before close of escrow. The first walk-thru should be completed about 6 or 7 days before close of escrow and then a second one done a day or so before the close of escrow, after any occupants have vacated the property. Will this earlier walk-thru guarantee discovery of a potential problem? – No, not necessarily (especially if the breach hasn’t occurred yet). Might it help you discover a problem before it’s too late to put into action some of the built-in remedies allowed for a breach of contract – specifically a 3 day cure notice delivered to the seller? – Absolutely!

Ultimately we will tell you this, when the property isn’t handed over in the same condition as it was when the contract was agreed upon, the solution is not as easy as the buyer refusing to close escrow and you could be forced to make some tuff decisions at the last minute. Make sure you are prepared for the possibilities and realize that this is one of the inherit risks of getting a great home at rock bottom prices.

Thanks for reading!

Etiquette and Manners for purchasing Short Sales in Arizona

Since Short Sales etiquette is not included in the Emily Post’s Etiquette Daily, I thought I might share a few things I have learned and observed the last 2 years that short sales has become a regular part of my real estate business.

Since Short Sales etiquette is not included in the Emily Post’s Etiquette Daily, I thought I might share a few things I have learned and observed the last 2 years that short sales has become a regular part of my real estate business.

1. Short Sale and Pre-Foreclosure are the same thing.

2. Make an extra effort to view a home advertised as ‘short’ or ‘pre-foreclosure’ when the occupants are not around. They don’t want to talk to you.

3. If you happen to run into owners or occupants/tenants while viewing a home advertised as a ‘short-sale’ Don’t ask them questions. If it’s a tenant, they might not even know that the owner is selling short and the owner might not be ready for them to know that yet. If it’s an owner….they are losing their home, this is not the time or place to ask questions. have your buyer’s agent discuss details with the owner’s listing agent. Don’t put the owner on the spot to discuss details of their uncomfortable position.

4. Just because someone is selling short, doesn’t mean that they do not deserve the same etiquette when scheduling appointments, keeping appointments, locking up and leaving your business card.

5. When writing a contract, DO NOT ask for any of the owners personal property including appliances, furniture, lawn equipment, etc. Don’t add insult to injury – they are already losing their home don’t ask for the few personal items of value they DO get to take with them.

Do you have a right to ask questions and find out specifics about the situation of the homeowners’ situation? If you are a consumer/buyer – you have the right to ask your agent. If you are an agent you better ask questions! Don’t ask the owner though, ask the co-operating agent. You need to find out some specifics regarding how many liens, amount and status of the liens, who holds them, at what stage the foreclosure is in, what documents have been sent to the bank etc…that is your job and you better do it – via the listing agent.

If you have additional items of etiquette for us to consider please leave a comment. Thanks for reading.

Tipping Point – Arizona Housing Market

The million dollar question for the last several years in the Phoenix Metropolitan area is “when will the housing market hit bottom?” This leads us to ask, “how does one define the ‘bottom of the market’? ” I am no statistician by any means, but you can only define “bottom” by looking backwards. One can’t state that we are at the bottom now without knowing what will happen next month and the month after. Usually when we talk about trends and defining trends in real estate, we want to see a four month consistency, or ‘last quarter’ type of stability. If March or April of 2009 is the bottom of the market price-wise, we won’t know until mid to late summer. We can only look back to determine with any certainty what the data tells us in relation to the broader picture.

Having said that we are definitely at a tipping point in the greater-Phoenix housing market. Let’s look at both ends of the supply and demand scale that impact our sales price.

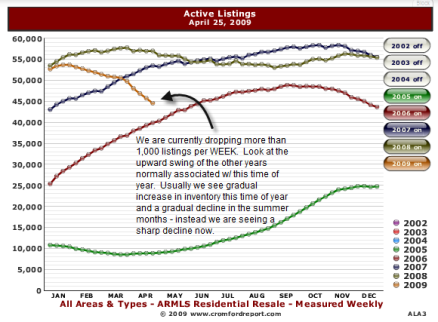

Supply is the inventory of homes we have available for purchase. At our peak in October 2007 we had 58,334 homes available. To contrast this figure with the other market extreme of 2005/6 our inventory of homes was at a whopping 8,342 in April of 2005. (Normal inventory is about 32,000 active listings) Now let’s look at the decrease in inventory over the last several months.

Phoenix Housing Market Decline First Quarter 2009

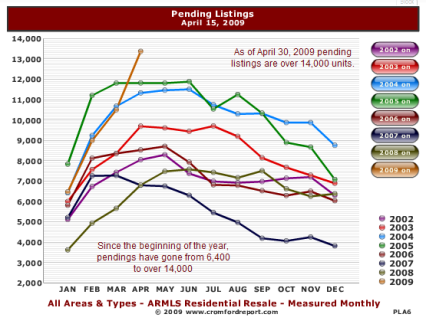

Now lets take a look at the supply side of the Phoenix housing market. Pending sales is our most current indicator of the demand for homes. While closed sales is arguably a more accurate indicator, because not every pending sale ends in a closed sale. Closed sales again are looking backwards. Pending sales are a more immediate picture of current demand. So what do the pending sales in the Greater Phoenix housing market tell us?

Highest amount of Pending Home Sales than any other time in history in Phoenix Metro area

As the above chart indicates, are pending sales are through the roof. As this chart is 2 weeks old now, our pending sales are even higher now at over 14,000 units. We are currently several thousands units above what are previous high in the 2005 market. I don’t know that we could have any clearer indicator of demand except what agents and buyers are experiencing out in the trenches right now.

Here is what I have heard from other agents in the last week. “I Can’t believe their were 18 offers on that house”, “2 of the 5 properties I was going to show my buyer went under contract last night” “The listing agent told me not to bother to write on homes if I was going to ‘low-ball’ – thing is, we only came in $5,000 under asking price – the listing agent told us we were the lowest price offer he had of 6.”

Thanks for reading.

![Reblog this post [with Zemanta]](https://i0.wp.com/img.zemanta.com/reblog_e.png)